Weekly Newletter #48

10/13/25

U.S.-China Tensions Slam Stocks

The U.S. stock market suffered its sharpest sell-off since April as geopolitical tensions with China unexpectedly flared late in the week. The S&P 500, Nasdaq 100, and Dow Jones all plunged on Friday, erasing roughly $2 trillion in market capitalization. Selling intensified into the close and deepened after hours, as futures fell further. The sudden trigger: a rare-earth minerals dispute and a new round of tariff threats from Washington that rattled global investors.

Calm Turns to Aggressive Selling

The week began quietly. Through midweek, equities held near record highs as investors clung to the “soft-landing” narrative - steady growth, falling inflation, and the prospect of rate cuts later this year. Tech stocks continued to lead, and volatility remained subdued.

Everything changed Thursday night when President Trump canceled his planned meeting with China’s President Xi Jinping, saying there was “no reason” for talks. He followed with a social-media post claiming “some very strange things are happening in China,” and threatened the possibility of imposing 100% tariffs on all Chinese imports. Markets, which had grown complacent after months of gains, were caught off guard.

By Friday morning, headlines about a rare-earth minerals’ confrontation dominated financial news. Traders immediately shifted to defense. Within hours, selling swept across sectors - from technology to energy to financials - as fears spread that the world’s two largest economies were heading toward another trade war.

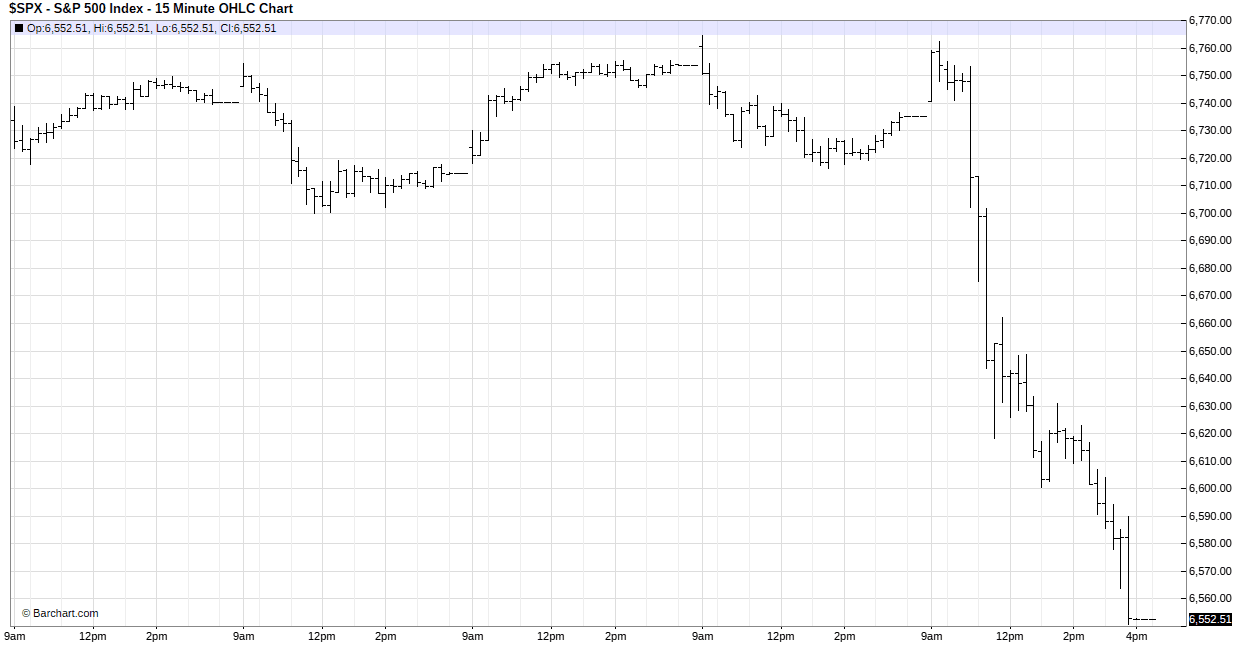

Please see below S&P 500 index cash chart, 5-day with 15-minute bars.

chart provided by barchart.com

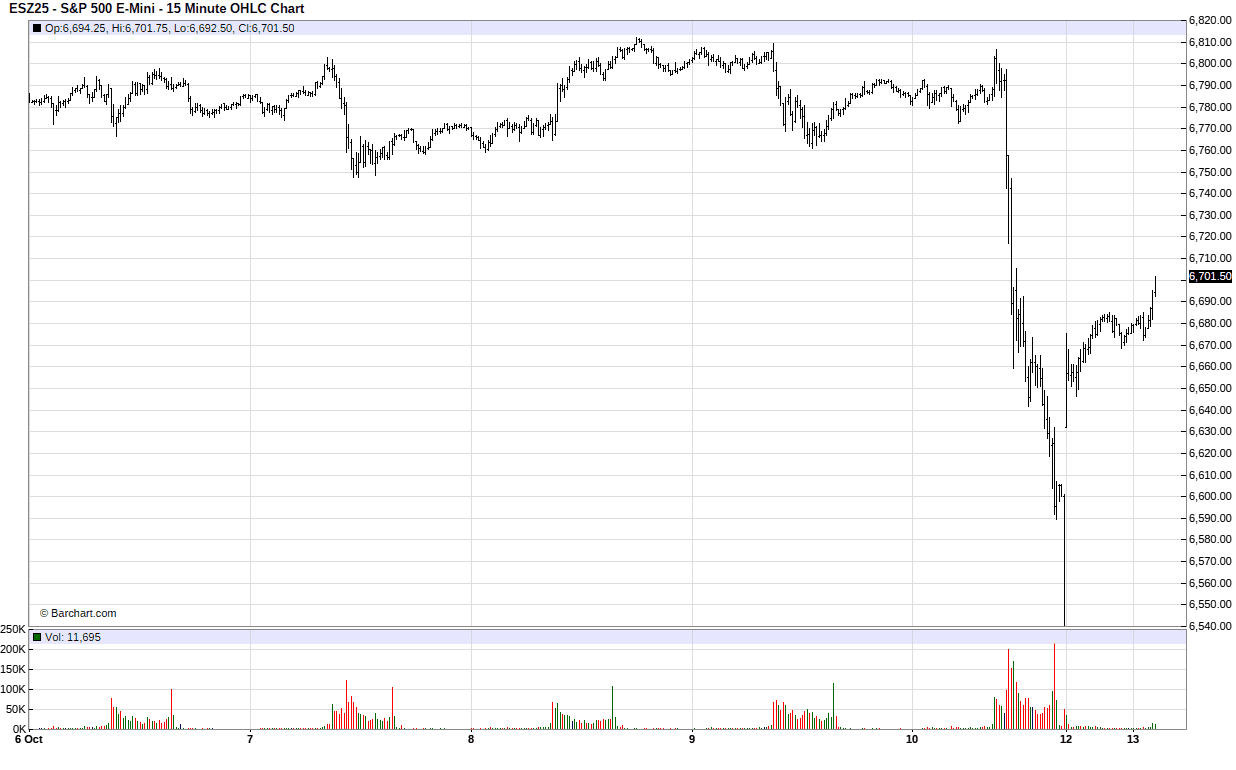

Please see below S&P 500 future (ES) chart, 5-day (plus Monday pre-market).

chart provided by barchart.com

The second chart shows the S&P 500 futures (ES). On the far right, Monday’s pre-market session shows futures recovering roughly half of Friday’s selloff, suggesting that prices may be stabilizing. However, a 50% retracement is typical in trading markets and doesn’t necessarily signal the end of the trend. Still, it marks an initial step toward normalization. Whether a V-shaped recovery holds remains to be seen.

Why Rare Earths Matter

Rare-earth elements - 17 metallic elements including the lanthanides, plus scandium and yttrium - are essential to modern technologies. They power smartphones, electric vehicles, wind turbines, semiconductors, and defense systems. Although not actually “rare,” these materials are difficult and costly to extract because they are often dispersed rather than found in concentrated deposits.

China controls roughly 60% of global production and an even higher share of refining capacity. The U.S. depends heavily on Chinese supply chains for these minerals. When Trump placed them at the center of a potential tariff conflict, investors quickly grasped the implications: any disruption could choke technology and manufacturing industries.

Tech Stocks Take the Hit

The S&P 500’s heavy weighting toward mega-cap technology magnified the damage. Giants like Apple, Nvidia, and Microsoft all slid sharply. The irony was clear: just weeks earlier, analysts had celebrated their record earnings and dominant market leadership. Now the very materials used to build their products were being thrust into a trade dispute.

From April’s low to October’s high, the S&P 500 had gained nearly 39%, an extraordinary run fueled by AI enthusiasm and easing financial conditions. A pullback was due. But this catalyst was not a routine profit-taking event; it was a sudden broad Sell-Off in Risk Assets.

Every major risk asset turned lower. Energy and industrial commodities sank as investors priced in slower global trade. Brent crude fell, while copper and aluminum declined sharply. Bitcoin dropped alongside equities. The only bright spot was gold, which held firm as investors sought safety. Treasury yields eased and the U.S. dollar strengthened modestly - classic signs of a flight to quality.

By Friday’s close, market breadth was overwhelmingly negative. Nearly 90% of S&P 500 components finished lower, and defensive sectors like utilities and healthcare showed only modest resilience.

A Wake-Up Call for Investors

For months, Wall Street’s mood had bordered on euphoric. The VIX volatility index hovered near multi-year lows as traders assumed the Fed had engineered a perfect outcome: slowing inflation without recession. Friday shattered that calm.

The sell-off reminded investors that geopolitical risk remains the market’s blind spot. Monetary policy can be analyzed and forecast; political behavior cannot. A renewed U.S.-China trade war could upend global supply chains, revive inflationary pressures, and undermine earnings projections - all while testing investor faith in the current bull run.

Monday Looms Large

The coming week will determine whether this was a one-day panic or the start of a broader correction. Futures suggest a price recovery heading into Monday. At the time of the writing of this report, S&P 500 futures were up in the pre-market session, making about a 50% price retracement.

If markets stabilize, analysts may label Friday’s rout as a sharp but healthy reset. However, if rhetoric hardens and tariffs advance toward reality, volatility could remain elevated well into November. Investors will also monitor any response from Beijing.

Cooler Heads Needed

A conflict over rare-earth minerals poses risks far beyond tariffs and trade balances. These materials underpin the digital economy itself. Diplomacy, not escalation, is urgently needed. Threats of 100% tariffs and retaliatory export bans would damage both nations and unsettle global growth prospects.

The market’s message is straightforward: the rally can survive normal corrections, but it cannot thrive on confrontation. After a Summer of steady gains, last week’s events served as a sharp reminder that politics can erase trillions in market value overnight.

Trading Perspective

Friday’s selloff was steep, with the market closing at the lows. What happens next, however, is what matters most.

As expected, my high-time-frame (HTF) model, which analyzes daily data, switched from BUY to SELL following Friday’s action. The new trend is downward and, given the sharp move, currently reads as a strong trend - though it’s still very young, only one day old. Based on pre-market activity at the time of this writing, S&P 500 futures (ES) have recovered significantly. Unless conditions change before the cash session opens, the S&P 500 is expected to gap up meaningfully at the open.

How should traders approach this? The selloff was headline-driven, so if the news flow shifts, the market could react quickly. With volatility now elevated, I plan to adjust trade sizes to match the new risk environment - smaller positions, wider stops, and larger targets.

If the S&P 500 opens strong, then on the low-time-frame (LTF):

• BUY: 5- and 15-minute bars, triggered by upward 5/20 SMA crossovers followed by an SMA bounce.

Otherwise:

• SELL: 5- and 15-minute bars, triggered by upward 5/20 SMA crossovers followed by an SMA bounce.

Traders must remain nimble. Unexpected news can shift sentiment quickly, so it’s essential to follow price trends closely and maintain disciplined risk management. If volatility remains high, I will trade both sides of the market - long and short - using 5-minute bars and the 5/20 SMA crossover-and-bounce methodology.

by Peter B. Levant, MBA, MSc Finance, Managing Director, Index Research LLC

Weekly Reports

Want us to cover a specific topic?

Whether it’s a sector, company, or macro theme you'd like to see explored — tell us. We continuously refine our research based on member input.